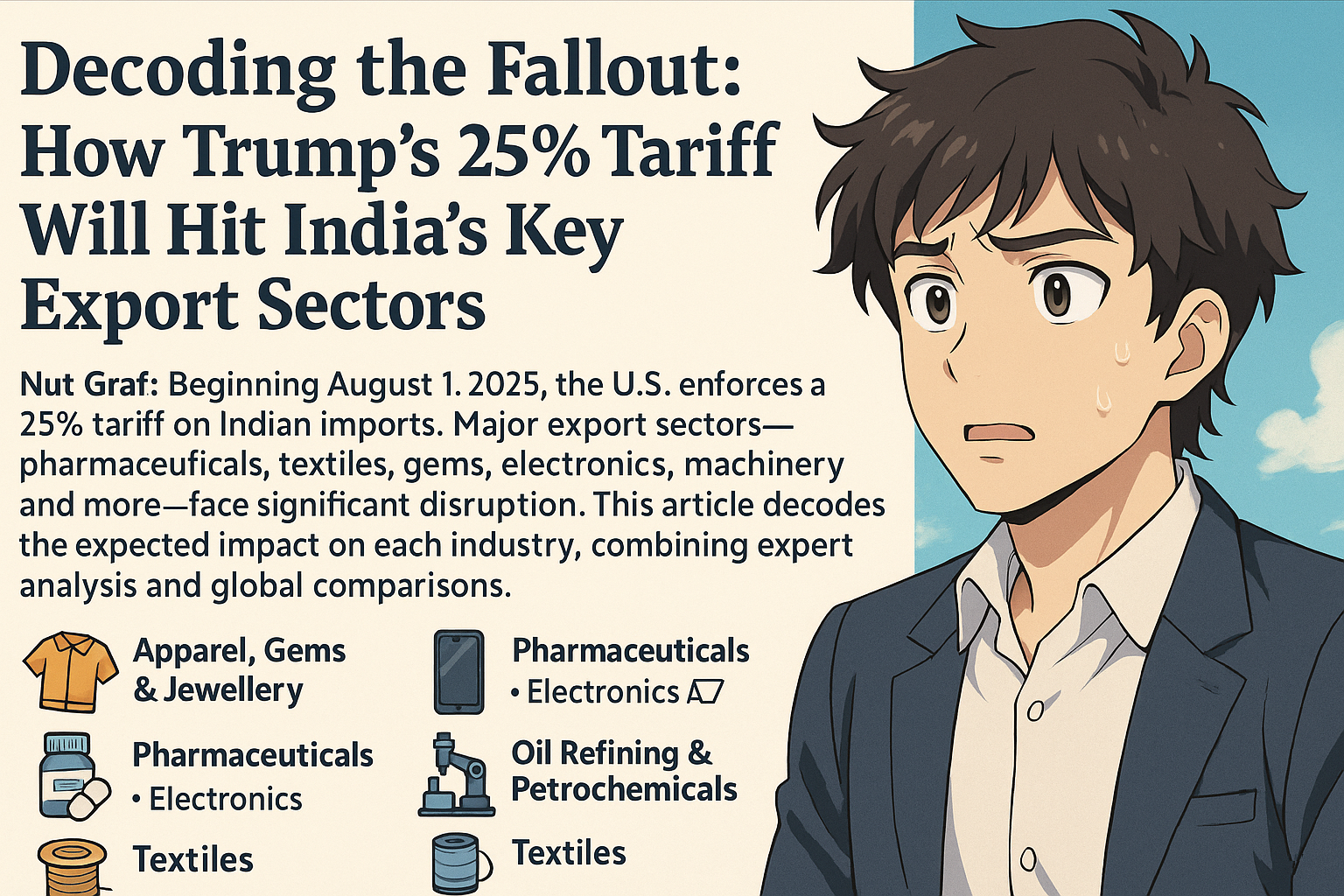

President Donald Trump’s decision to impose a 25% tariff on Indian imports from August 1, 2025, signals a sharp escalation in trade tensions. This article investigates the rationale, economic fallout, political ramifications, and the broader strategic implications of this unprecedented move.

WHO: Identifying the Key Players

At the center of this geopolitical upheaval is U.S. President Donald Trump, whose July 30 announcement on Truth Social targeted India for what he called "one of the highest trade barriers in the world." The decision ties directly to Trump’s broader "Liberation Day" tariff policy and takes aim at Prime Minister Narendra Modi’s government, which has been striving to bolster India’s global manufacturing footprint.

In Washington, the U.S. Trade Representative’s office and the Department of Commerce have echoed the President’s stance, citing India’s complex non-tariff barriers and preferential treatment of Russian energy imports as critical concerns.

On the Indian side, Commerce Minister Piyush Goyal and External Affairs Minister S. Jaishankar have led the diplomatic response, vowing to protect key sectors and prevent long-term damage to India’s global standing. Opposition leaders in India, particularly from the Congress party, have accused the Modi government of mishandling bilateral relations.

Multinational corporations such as Apple (via Foxconn), Reliance Industries, and exporters from Gujarat, West Bengal, and Tamil Nadu are directly impacted. Industry bodies like FIEO and CII are calling for immediate relief and trade dialogues.

WHAT: Laying Bare the Core Issue

Trump's tariff is not merely an economic maneuver; it's a signal of deteriorating strategic patience. At 25%, the new U.S. import duty on Indian goods matches the high end of Trump’s "reciprocal tariff" policy launched earlier in 2025.

Trump cited three primary reasons:

- Trade imbalance: Despite India's growing imports from the U.S., the $40 billion trade deficit (2024) remains a sticking point.

- High import barriers: Trump pointed to India's average tariff rate of 17.6% and non-tariff barriers in agriculture, pharmaceuticals, and electronics.

- Geopolitical defiance: India’s continued purchases of Russian crude and participation in the BRICS alliance were labeled as "strategically unaligned" by U.S. officials.

Tariff Comparison Snapshot:

- India: 25%

- Japan/EU: 15%

- Vietnam: 20%

- Indonesia: 19%

WHEN: Tracing the Timeline

- April 2, 2025: Trump launches the "Liberation Day" tariff regime via executive order under the International Emergency Economic Powers Act (IEEPA).

- May - July 2025: India and U.S. engage in backchannel diplomacy; talks stall over defense procurement and agricultural access.

- July 30, 2025: Trump officially announces the 25% tariff on Indian imports via Truth Social.

- July 31, 2025: Appeals against the Liberation Day tariffs are heard in federal court. Rulings on presidential overreach under IEEPA are pending.

- August 1, 2025: Tariffs go into effect.

- Fall 2025: Deadline set for finalizing a bilateral trade pact.

WHERE: Pinpointing the Geographic Impact

The tariffs are likely to disproportionately affect India’s export-heavy states:

- Gujarat: Known for ceramics, chemicals, and garments, local MSMEs fear job losses and diminished U.S. demand.

- Tamil Nadu: Home to automotive and textile hubs, exporters brace for reduced competitiveness.

- West Bengal: Tea, leather, and jute industries anticipate profit erosion.

- Maharashtra: Pharma and electronics exporters report uncertainty about U.S. contracts.

Global Parallel:

- Japan: Eliminated tariffs on U.S. semiconductors by 2016.

- Brazil: Faced a similar 20% penalty in 2021 under Trump’s first term.

- Russia: Subjected to a 40% import tax on steel under the Liberation Day policy.

WHY: Uncovering the Root Causes

The real drivers go beyond trade math. Trump’s pivot toward a harder geopolitical line—tied to India’s neutral stance on the Ukraine war—has changed the calculus.

"This isn’t just about tariffs. It’s about sovereignty. India must choose a side," said a senior White House official.

The U.S. believes India’s deepening ties with Russia undermine Western sanctions, especially as India remains a major buyer of discounted Russian oil.

Additionally, India’s increasing leadership in BRICS is viewed as a threat to U.S.-led global trade norms. Trump’s tariff thus serves as both punishment and leverage.

Institutional Paradox: Despite WTO norms prohibiting unilateral punitive tariffs, the U.S. has invoked national security as a cover under IEEPA.

HOW: Offering Solutions & Empowering Action

India’s options include:

- Fast-track U.S. trade deal: Negotiators are expediting a bilateral agreement focused on tariff relief for textiles, pharma, and agri-tech.

- Protective measures: Import subsidies, credit guarantees, and MSME support packages are in development.

- Strategic diversification: Boosting exports to the EU, ASEAN, and Africa to offset U.S. losses.

- Legal channels: India is preparing to challenge the tariffs at the WTO, citing non-compliance with international rules.

- Public advocacy: Industry groups are lobbying the U.S. Congress and diaspora communities to pressure the White House.

How You Can Help:

- Support MSMEs: Buy local to offset the tariff impact.

The Denouement: What Lies Ahead

The 25% tariff on Indian imports is not just a trade barrier; it's a geopolitical gambit. It challenges India’s delicate balance between strategic autonomy and global integration. As trade talks continue and legal battles unfold, the path ahead remains uncertain but crucial.