In a defining chapter of India’s economic diplomacy, a high-level delegation led by Commerce Minister Piyush Goyal and Chief Trade Negotiator Rajesh Agrawal is in Washington for a decisive four-day negotiation sprint. The mission: finalize an interim trade pact with the United States before the August 1 tariff deadline and set the stage for a comprehensive bilateral trade agreement (BTA) later this year.

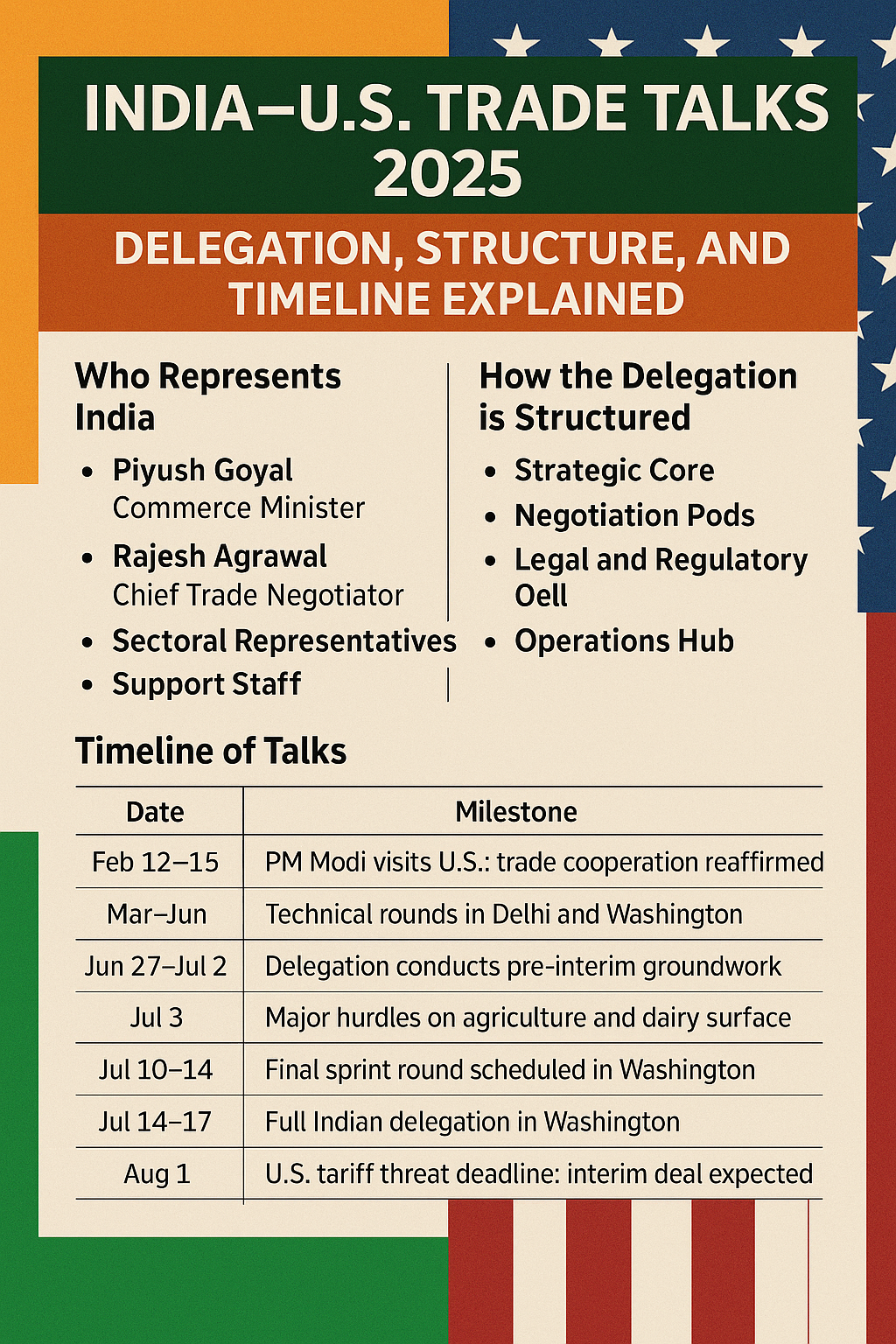

Who Represents India

India's team features a combination of strategic leaders, technical negotiators, and sectoral experts:

- Piyush Goyal: The lead face of India's trade strategy, ensuring political alignment and high-level diplomacy.

- Rajesh Agrawal: Special Secretary and Chief Trade Negotiator, driving the technical, clause-by-clause negotiations.

- Deputy Chief Negotiator: A senior official from the Commerce Ministry helping set agendas and drive operational delivery.

- Sectoral Representatives: Experts in agriculture, dairy, automotive, pharmaceuticals, textiles, energy, and legal frameworks.

- Support Staff: Legal advisors, WTO specialists, administrative aides, and data analysts ensuring smooth coordination.

This carefully structured team ensures India’s interests are negotiated with precision, supported by deep data and real-time insights.

How the Delegation is Structured

The delegation is organized in a hierarchical yet agile manner:

- Strategic Core: Goyal and Agrawal steer the policy direction and key decisions.

- Negotiation Pods: Sector-specific sub-groups for agriculture, dairy, steel, automotive, pharma, and energy.

- Legal and Regulatory Cell: Handles forward-looking clauses such as “Most-Favored-Nation” and dispute resolution.

- Operations Hub: Takes care of logistics, documentation, virtual briefings, and real-time analysis.

Each subgroup is empowered to engage in focused negotiations, with escalation protocols to the strategic core for critical decisions.

Timeline of Talks

| Date | Milestone |

|---|---|

| Feb 12–15 | PM Modi visits U.S.; trade cooperation reaffirmed |

| Mar–Jun | Technical rounds in Delhi and Washington |

| Jun 27–Jul 2 | Delegation conducts pre-interim groundwork |

| Jul 3 | Major hurdles on agriculture and dairy surface |

| Jul 10–14 | Final sprint round scheduled in Washington |

| Jul 14–17 | Full Indian delegation in Washington |

| Aug 1 | U.S. tariff threat deadline; interim deal expected |

| Fall 2025 | Full-phase agreement targeted |

| The immediate goal is an interim agreement before August 1, followed by a first-phase BTA in autumn and a comprehensive pact by 2026. |

What’s India’s Strategy

Agriculture and Dairy: The Red Line

India refuses to open its agriculture and dairy markets beyond existing WTO commitments. This is rooted in concerns about rural employment, food security, and exposure to heavily subsidized U.S. products.

India is open to:

- Limited access for specific GM-free feed products.

- Certainty mechanisms on animal health standards.

- Consultative clauses rather than full liberalization.

But it will not:

- Allow unrestricted entry of U.S. dairy and poultry.

- Agree to GM food imports or animal feed standards that override Indian norms.

Automotive and Steel: Measured Trade-Offs

The U.S. seeks tariff reductions on EVs and parts. India counters with:

- Tariff-equivalent swaps (zero-for-zero principle).

- Carve-outs for indigenous EV development programs.

- Regulatory alignment on emission and safety certifications.

India is willing to open parts of the auto ecosystem but will not compromise its domestic production priorities.

Pharmaceuticals and Medical Devices

The U.S. wants enhanced access for drugs and devices, citing regulatory hurdles.

India responds with:

- Simplified approval timelines for U.S. generics and devices.

- Retaining autonomy over IP policy, especially for life-saving generics.

- Bilateral regulatory cooperation frameworks.

This sector could see partial opening under mutual trust mechanisms.

Energy, Tech and Defense

While not part of the core interim deal, India and the U.S. are aligning on:

- Long-term LNG and crude import contracts.

- Bilateral tech partnerships in semiconductors and AI.

- Defense trade expansions under co-production models.

These areas support the broader strategic vision of Indo–U.S. ties.

Tariff Negotiation Dynamics

India has offered:

- Deep tariff cuts on U.S. almonds, apples, chemicals, toys, and engineered goods.

- Protection for rice (up to 80 percent), dairy (up to 60 percent), and sensitive crops.

- A “forward MFN” clause to auto-extend better terms given to other partners.

The U.S. may:

- Cap tariff threats for India below 20 percent, a major shift from the original 26 percent.

- Delay tariff reinstatement till after the interim agreement is concluded.

This back-and-forth reflects intense political and economic calculations.

Interim Deal vs. Full Trade Agreement

- Interim Deal (August 2025): Focuses on goods, tariff access, agriculture safeguards, and structural clauses.

- Phase 1 BTA (Fall 2025): Expands scope to cover industrial goods, digital trade, sanitary standards, and dispute settlement.

- Full BTA (2026): Targets services, labor, IP, e-commerce, and customs procedures—potentially requiring U.S. congressional approval.

India prefers a phased approach, securing immediate trade relief while laying the foundation for a robust, long-term pact.

Why This Deal Matters

- Protects ₹6 lakh crore worth of Indian exports from sudden tariffs.

- Safeguards employment across agriculture, pharma, and textiles.

- Deepens strategic alignment with the U.S. amid global trade realignments.

- Helps India achieve its $500 billion bilateral trade goal by 2030.

- Enhances investor confidence in India’s policy stability.

In essence, this deal isn't just about goods—it’s about signaling India’s readiness to lead in a multipolar world economy.

Challenges Ahead

- High domestic sensitivity around farmer groups and trade unions.

- Risk of over-dependence on U.S. markets amid BRICS realignment.

- Trump administration’s tough stance on tariff enforcement.

- Congressional uncertainty in the U.S. for future BTA ratification.

India walks a tightrope between economic opportunity and strategic caution.

What to Watch Next

- Joint Statement – Possibly on or after July 17.

- Tariff Relaxation Confirmation – Whether the U.S. commits to the sub-20 percent cap.

- Draft Text Review – For legal alignment and political ratification.

- Industry Reactions – Particularly from pharma, dairy, and auto sectors.

Final Take

India’s trade team is working round-the-clock in Washington to seal a deal that protects national interest while unlocking global opportunity. The interim pact could be a historic bridge toward an ambitious new era of Indo–U.S. economic partnership.

India is not negotiating out of desperation—but from a position of strategic strength, national pride, and long-term vision.

Quick Vision